san francisco sales tax rate breakdown

The minimum sales tax in California is 725. A base sales and use tax rate of 725 percent is applied statewide.

The California state sales tax rate is currently.

. The tax rate given here will reflect the current rate of tax for the address that you enter. In San Francisco transfer taxes upon change of ownership are typically paid by the Seller though it can be otherwise agreed to in the purchase contract. This tax does not all go to the state though.

State Local Sales Tax Rates As of January 1 2020. Sales Tax Rate Changes in Major Cities. Our GIS-based sales tax website allows the user to view sales tax receipts from calendar years 2017 to 2021 in.

Related

These rates are weighted by population to compute an average local tax rate. Nonresidents who work in San Francisco also pay a local income tax of 150 the same as the local income tax paid by residents. The December 2020 total local sales tax rate was 9250.

Fast Easy Tax Solutions. This is the total of state and county sales tax rates. 4 rows Sales Tax Breakdown.

5110 cents per gallon of regular gasoline 3890 cents per gallon of diesel. San Francisco California sales tax rate. Please ensure the address information you input is the address you intended.

Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. State sales tax rates. Presidio of Monterey Monterey 9250.

Otherwise you will owe the annual tax rate of 884 and must file Form 100 California Franchise or Income Tax Return. Type an address above and click Search to find the sales and use tax rate for that location. The true state sales tax in California is 6.

The sales tax rate can jump in other areas of the county. California Sales Tax. San Francisco imposes a 14 transient occupancy tax on the rental of accommodations for stays of less than 30 days.

The state then requires an additional sales tax of 125 to pay for county and city funds. The sales tax jurisdiction name is San Jose Hotel Business Improvement District Zone A which may refer to a local government division. This scorecard presents timely information on economy-wide employment indicators real estate and tourism.

Economy The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy. San Francisco Co Local Tax Sl 1. The minimum combined 2022 sales tax rate for Contra Costa County California is.

The transient occupancy tax is also known as the hotel tax. 3 rows Sales Tax Breakdown. B Three states levy mandatory statewide local add-on sales taxes at the state level.

A City county and municipal rates vary. The tax is collected by hotel operators and short-term rental hostssites and remitted to the City. Since 1974 the San Francisco sales tax rate has increased eight times from 650 percent to the current rate of 850 percent.

Sales tax may be added to the cost of buying goods and services at US retail locations. Twenty-five major cities saw an increase of 025 percentage points or more in their combined state and local sales tax rates over the past two years including 10 with increases in the first half of 2019. South San Francisco CA Sales Tax Rate.

More than 100 but less than or equal to 250000. 250 for each 500 or portion thereof. Those district tax rates range from 010 to 100.

Nineteen major cities now have combined rates of 9 percent or higher. California requires S corporations to pay a 15 franchise tax on income with a minimum tax of 800. If entire value or consideration is X then the Tax rate for entire value or consideration is Y.

Presidio San Francisco 8625. The statewide tax rate is 725. California 1 Utah 125 and Virginia 1.

Ad Find Out Sales Tax Rates For Free. San Francisco has plenty of hidden costs though luckily weve broken them down for you. Here are some additional costs to consider in San Francisco.

Some 45 states plus the District of Columbia use state-wide base sales tax rates - while there are 5 states with no sales tax at state level. San francisco Tax jurisdiction breakdown for 2022. San Francisco County District Tax Sp 138.

California has a 6 sales tax and San Francisco County collects an additional 025 so the minimum sales tax rate in San Francisco County is 625 not including any city or special district taxes. The San Francisco County California sales tax is 850 consisting of 600 California state. All in all youll pay a sales tax of at least 725 in California.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. 5 digit Zip Code is required. 4 rows The 8625 sales tax rate in San Francisco consists of 6 California state sales tax.

The Contra Costa County sales tax rate is. Tax rate for nonresidents who work in San Francisco. Filing Requirements from the CA Franchise Tax Board.

File Monthly Transient Occupancy Tax Return. The amount paid varies by locality. San Francisco residents can expect to pay a minimum combined 85 sales tax rate.

The 9875 sales tax rate in South San Francisco consists of 6 California state sales. 073 average effective rate.

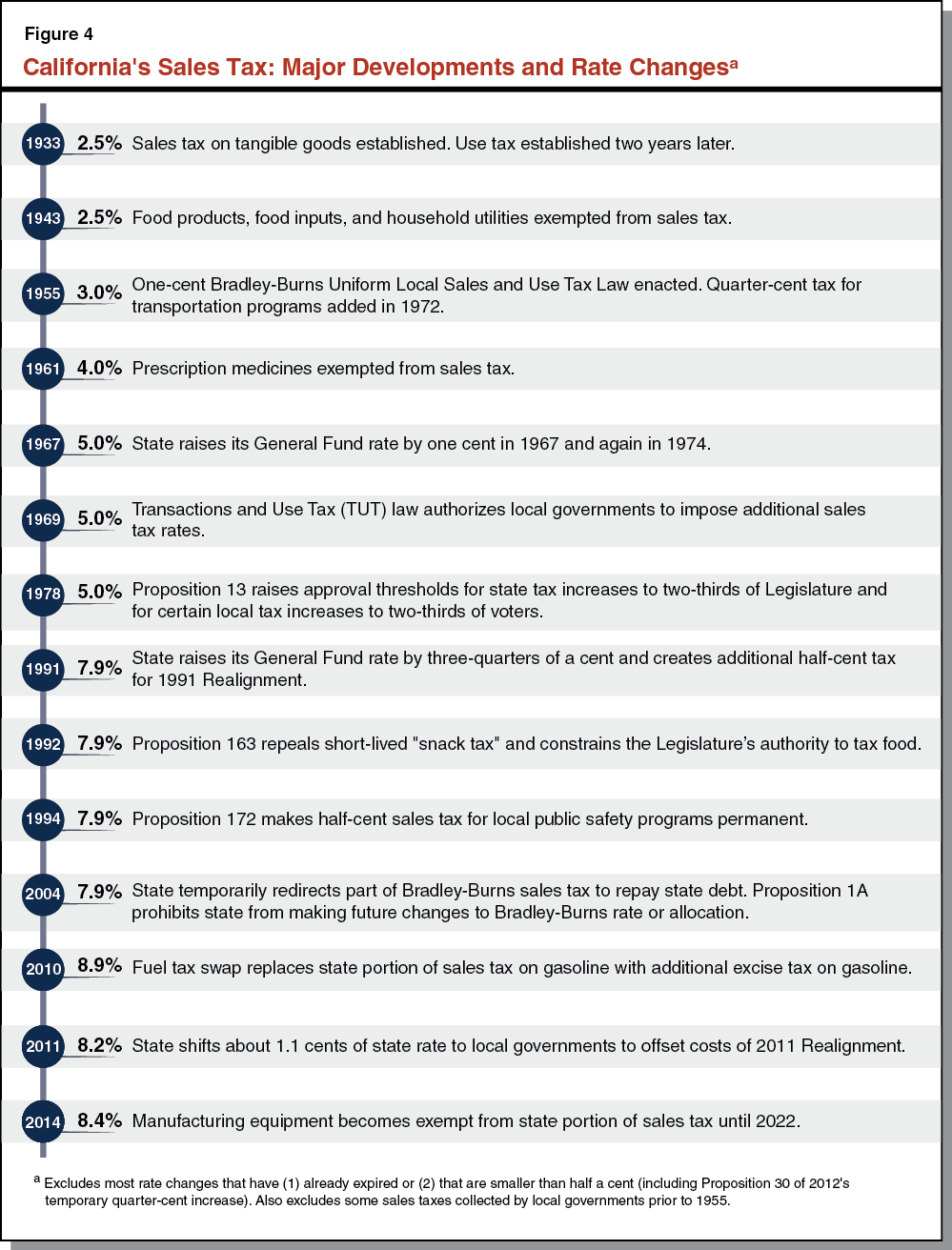

Understanding California S Sales Tax

Understanding California S Sales Tax

Understanding California S Sales Tax

California City County Sales Use Tax Rates

San Francisco Property Tax Rate To Rise Where The Dollars Will Go

Understanding California S Sales Tax

How Do State And Local Sales Taxes Work Tax Policy Center

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Sales Tax Collections City Performance Scorecards

Frequently Asked Questions City Of Redwood City

Sales Tax By State Is Saas Taxable Taxjar

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

How Do State And Local Sales Taxes Work Tax Policy Center

Understanding California S Sales Tax

94110 Sales Tax Rate Ca Sales Taxes By Zip

Understanding California S Sales Tax

Us Sales Tax On Orders Brightpearl Help Center

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur